How to Get an Instant Loan in the UAE: A Simple Step-by-Step Guide

Life in the UAE moves fast, and sometimes your finances just can’t keep up. Whether it’s an unexpected medical bill, last-minute travel expense, or just a tough end-of-the-month stretch, there are times when you need cash quickly. That’s where instant loans come in.

But with so many options out there, it’s easy to feel overwhelmed. If you’ve ever found yourself searching how to get an instant loan in the UAE, this simple guide is here to help.

What is an instant loan, its pros, and the cons

An instant loan, in simple terms, is a short-term, small-ticket loan that’s accessible almost instantly, often within seconds or minutes. It’s best known as an alternative to traditional personal loans, which can fall short in emergencies due to longer approval timelines that typically range from a day to several days.

Instant loans are usually offered by digital-first lenders and new-age FinTech platforms, requiring minimal paperwork. Other attractive features of this loan option include a 100% digital process, quick disbursal, and easy access through mobile apps, making it a go-to solution for immediate financial needs.

Pros of an instant loan

Instant loans are the best option if you are in need of immediate funds, and here’s what makes them worth considering:

- Fast approval and disbursement - The typical turnaround time for an instant loan is under 60 minutes, even faster with some FinTech providers, making it a solid choice for emergencies or when you need immediate cash.

- Fully digital process - Instant loans are a product of digital-first firms or digital-only FinTechs, hence the entire process from application to disbursal happens online. You don’t need to visit a branch, make agent calls, or deal with in-person paperwork.

- Minimal documentation - The digital process is built with convenience in mind, i.e., with minimal steps involved. All that’s usually required are basic documents like your ID, income proof, and bank details, all submitted digitally within the app.

- Ideal for short-term needs - Instant loans are well-suited for urgent, short-term needs like medical emergencies, unplanned travel, or last-minute bill payments, helping you quickly bridge sudden cash gaps.

Cons of an instant loan

Instant loans don’t come without trade-offs, so here are a few downsides to keep in mind before choosing them:

- Higher interest rates - These loans, because of their nature of speed and risk associated, come with significantly higher interest rates as compared to traditional personal loans. Many also come with hidden charges buried in the fine print, making them even more expensive if not repaid on time.

- Short repayment periods - Instant loans are, by nature, short-term. Repayment windows usually span just a few weeks or months, which can be challenging to manage and may lead to a cycle of debt if not planned carefully.

- Scam risks - Not all digital lenders are licensed or regulated, which a key marker of legitimacy. It’s essential to borrow only from verified, RBI-approved platforms to protect yourself from scams and potential misuse of personal data.

Step-by-step guide to get an instant loan in the UAE

Instant loans in the UAE are designed for speed and ease, and if you are in need of one, here’s a quick step-by-step guide to help you through the process:

Step 1: Understand what "Instant Loan" really means

An instant loan is a short-term borrowing solution that offers quick disbursement, often within minutes to a few hours. These loans are designed for emergencies or urgent needs and typically come with simpler documentation and faster processing than traditional loans.

Here's a quick comparison of common instant loan types in the UAE:

Step 2: Check if you’re eligible

Before you apply, ensure you meet the basic eligibility criteria. These vary slightly by provider but generally include:

Some platforms like CashNow also accommodate freelancers and self-employed individuals. Always check provider-specific rules.

Step 3: Get your documents ready

Preparing your documents in advance speeds up your application and avoids delays. Here’s what you’ll typically need:

- Emirates ID (Front and back)

- Salary proof (Latest payslip or bank statement showing salary credit)

- Bank account details (IBAN or account number)

- UAE mobile number (for verification and SMS)

Take clear photos or scan these documents and store them securely on your phone or cloud.

Step 4: Choose the right type of lender for you

Your loan type depends on how much you need, how soon you need it, and your existing resources:

- If you need more than AED 20,000

→ Try a bank personal loan. It offers lower interest and longer tenure but takes a few days to process and the process can be cumbersome with lots of document scrutiny.If you already have a credit card

→ Use cash advance. Do check fees and interest rate carefull - If you need cash quickly of AED 500–10,000

→ Use a licensed loan app like CashNow or others for fast approval and disbursement

Make sure the loan provider is licensed by the UAE Central Bank or a regulated financial institution.

Step 5: Apply online or through an app

Most banks now offer online applications, but they may still take time for approval. For fastest access, loan apps are usually your best bet.

Here’s how the process typically works for loan apps:

- Download the app

- Register with your Emirates ID and phone number

- Enter income details and upload salary proof

- Choose your loan amount and duration

- Submit an application and wait for approval (some are instant!)

Once approved, the money is usually transferred directly to your bank account or via a linked wallet.

Step 6: Know the repayment terms

Before accepting a loan, always read the fine print:

- Loan tenure (number of days or months)

- Interest or service fee

- Repayment due date (set a reminder!)

- Late fee policy

Some apps offer auto-debit, while others may require manual repayment through bank transfer or wallet.

Red flags to watch for when applying for loans

Digital platforms are either super convenient or a scam that’s too good to be true, and here’s how you can develop an eye for fraudsters before applying:

Upfront fees or “processing” charges before approval

Just like job offers that ask for registration charges, any lender requesting money (in the form of fees or processing charges) before loan approval is a major red flag.

Legitimate apps and institutions that genuinely want to help people in need will never ask for upfront “processing” or “registration” fees. If you're asked to pay anything before even seeing your loan terms, it’s a clear sign to walk away.

No physical address or license information

It doesn’t matter whether the lender is digital-only with no physical branch, or digital-first with most services happening online, legit businesses are always licensed and regulated. Their credentials are available publicly for verification.

If you can’t find a registered office address, license number, or regulatory approval (like from the UAE Central Bank), that’s a clear sign something’s off.

Overly aggressive marketing or calls

Legit lenders might have a solid marketing strategy to attract users, but that doesn’t mean harassing you with non-stop calls, texts, or DMs.

If you’re being pressured to borrow money quickly, it signals a lack of empathy and a profit-first mindset. Ethical lending comes without pressure, and you must choose brands that genuinely care for their customers’ financial upliftment.

Suspicious terms and hidden clauses

Trustworthy lenders prioritize clarity and will ensure that all terms and conditions are clearly communicated at every step.

If you come across a lender that buries key details like interest rates, penalties, or repayment terms in fine print or vague language, that’s a shady practice. Always read the full loan agreement, and if something doesn’t feel right, it probably isn’t.

Lack of customer service

Customer support is just as important as the loan product itself, especially when financial transactions are involved.

If your lender doesn’t provide a support number, email, or in-app chat for assistance, that’s a red flag you can’t afford to ignore. Reliable lenders offer responsive, accessible customer service because trust is the foundation of financial services..

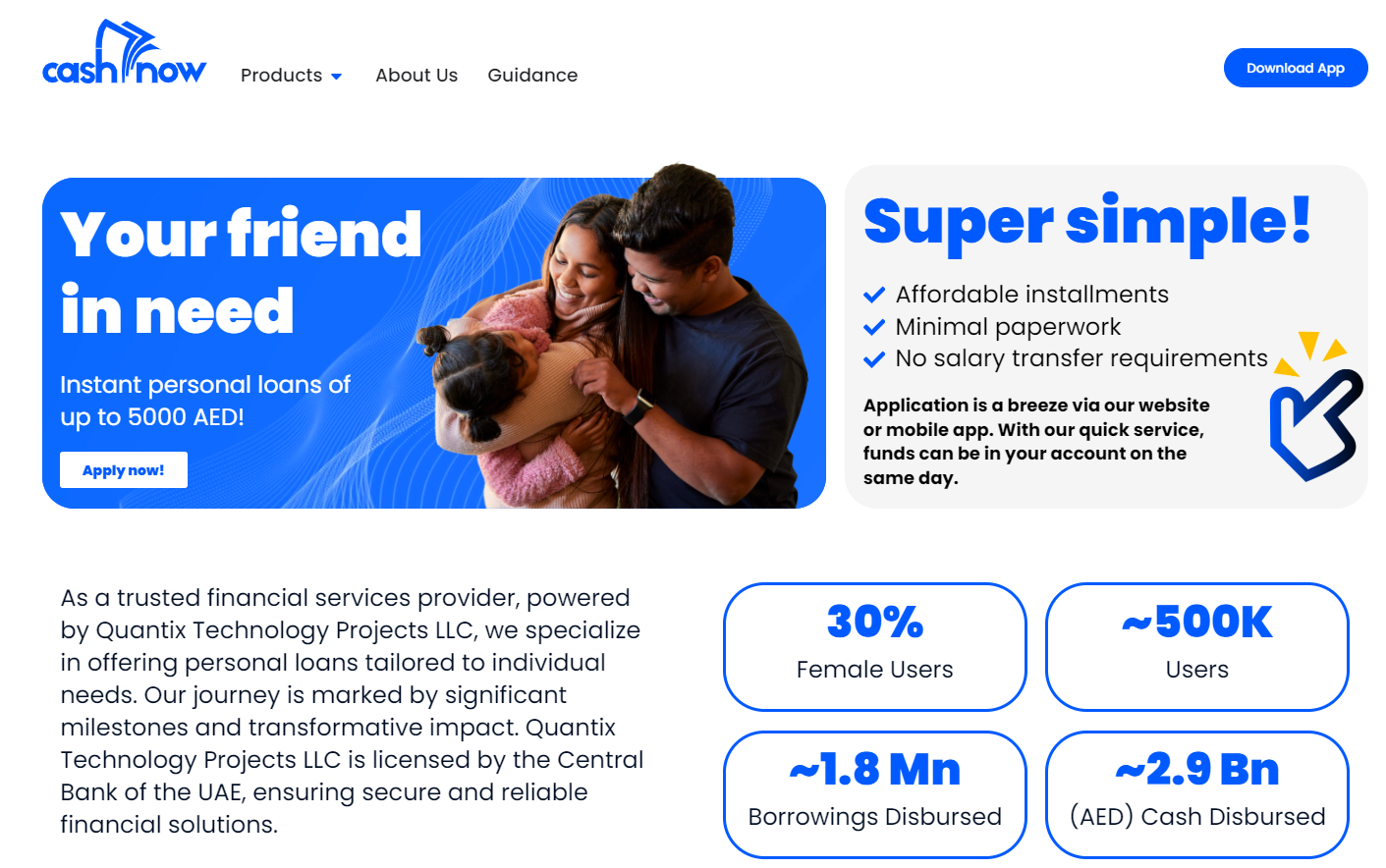

Why CashNow is a top choice in the UAE

Among the many loan apps, CashNow stands out for its combination of speed, simplicity, and transparency. Whether you’re an expat worker, salaried employee, or small business owner, CashNow offers a streamlined loan process that’s accessible to all.

Benefits:

- Instant approval

- Money transferred within minutes

- Minimal paperwork

- Clear repayment terms upfront—no hidden fees

- Available across the UAE. Trusted by thousands of users

If you're in a crunch and wondering how to get an instant loan in the UAE, CashNow app is one of the most reliable and fastest ways to do it.

Tips to improve your chances of getting approved

Approvals in instant loans are quicker but not guaranteed, which is why you need to prepare in advance, and here’s what you can do to speed up things up and avoid unnecessary rejections:

Keep your account active

Modern lenders offering instant loans may not rely on your credit score, but they definitely look for signs of financial stability.

An active bank account with regular salary credits works as a strong alternative to a credit score. Frequent, predictable transactions signal consistency, increasing your chances of approval significantly. Just avoid depleting your account too often or leaving your balance near zero.

Upload clear documents

This is the ABC of eKYC, but mistakes still happen. Submitting blurry, cropped, or hard-to-read documents can cause avoidable delays or worse, instant rejection.

Always upload sharp, well-lit images of your Emirates ID, income proof, and other required documents. Do a quick check before submitting to ensure everything’s legible and complete.

Check your Emirates ID

FinTechs typically require the most basic set of identity documents, mainly the Emirates ID, as it's key to verifying who you are.

An expired or soon-to-expire ID is often a dealbreaker due to regulatory and risk concerns. Before applying, make sure your ID is valid through your expected loan tenure and renew it if needed.

Use the right mobile number

Your registered mobile number is a crucial part of your verification. If the number on your application doesn’t match the one linked to your bank or payroll records, the process may fail. Use the same number tied to your financial records to avoid identity mismatches and ensure a smoother verification flow.

Avoid reapplying too soon

While many digital lenders don’t depend heavily on credit scores, maintaining a healthy profile still matters. If you get rejected, don’t rush to reapply. Multiple failed attempts can dent your credit standing. Instead, understand the reason, improve your profile, and only then try again.

Conclusion

When you're already stressed about money, the last thing you need is more hassle.

Instant loans are built to ease your burden, but they can quickly do the opposite if you choose the wrong lender. Digital lenders and FinTech apps are streamlining the process by providing instant access to funds during emergencies.

But speed shouldn’t come at the cost of caution.

You can do your homework and make sure you meet the eligibility criteria, submit clear documents, and only borrow from verified, licensed platforms or access all the information right away with Cashnow, because it stands by transparency.

Get started with Cashnow today.

FAQS

Q. Can non-residents apply for instant loans in the UAE?

A: No, instant loans are only available to UAE residents, and they must have a valid Emirates ID or residence visa to be eligible for approval.

Q. Will applying for an instant loan affect my credit score?

A: It depends. Apps like CashNow perform soft checks, but if your loan activity is reported to AECB (Al Etihad Credit Bureau), it can influence your credit score over time.

Q. Can I get a loan without a salary transfer?

A: Yes. Many FinTech lenders accept salary slips or income statements instead of requiring a bank salary transfer history, making loans more accessible to freelancers and contractors

Q. What happens if I miss a repayment?

A: The consequences of late repayments are penalties and impact on credit score. Continued defaults might also result in collections, account blocks, or potential legal action.

Q. Can I extend my repayment period?

A: Some platforms offer extensions or split-payment options, but they often include additional charges. Always check the fine print before committing to a new schedule.

.webp)

.webp)